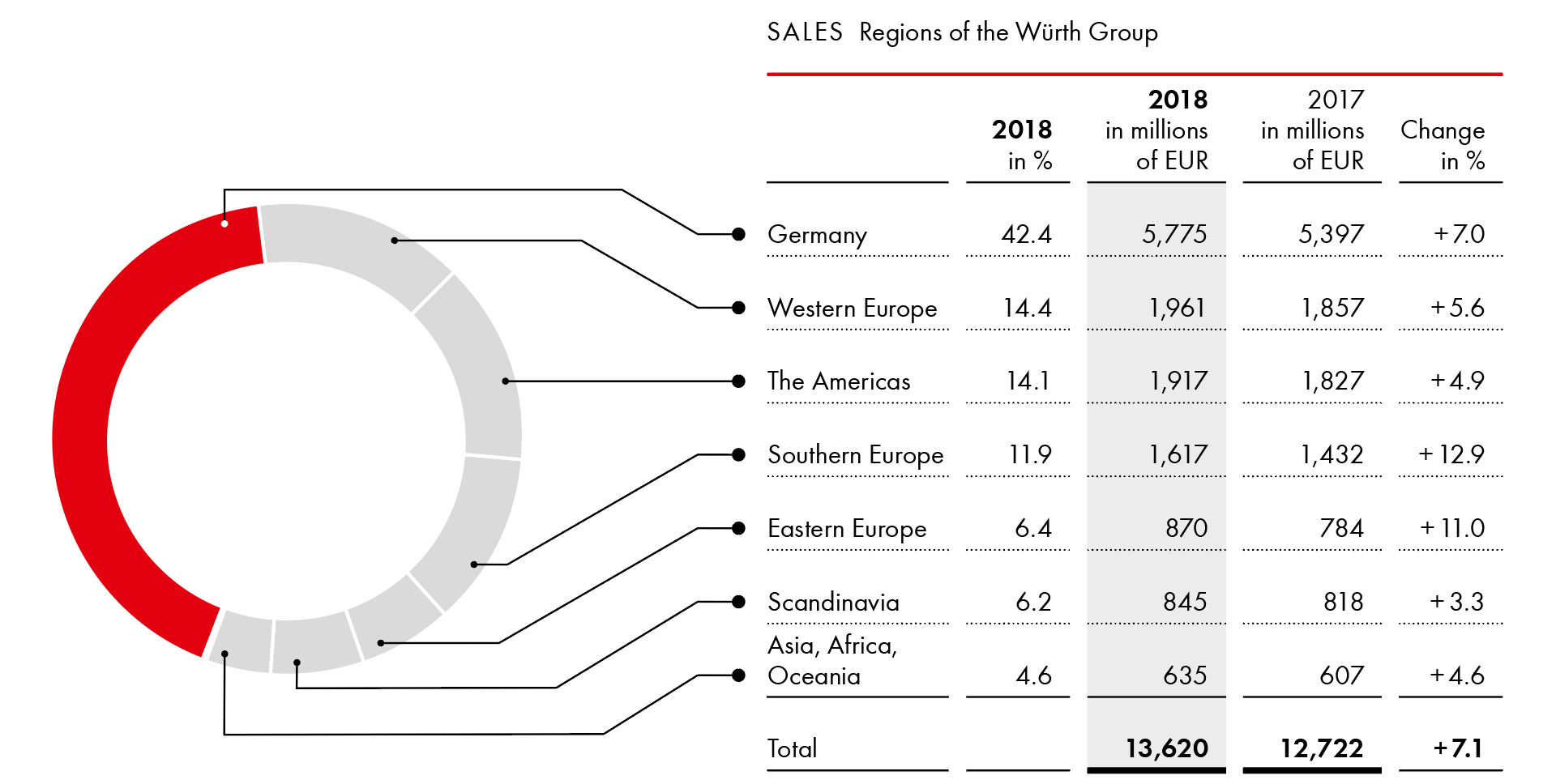

Sales by region

- Germany, most important single market, grows by 7.0 percent

- Strongest growth in Southern Europe

- Italy benefits from company acquisition

With a growth rate of 12.9 percent in 2018, Southern Europe was the region with the strongest growth within the Würth Group, showing above-average sales growth over the last four years, which was also bolstered by acquisitions. Eastern Europe also achieved double-digit growth of 11.0 percent, although the very high growth level of the past two years could no longer be sustained.

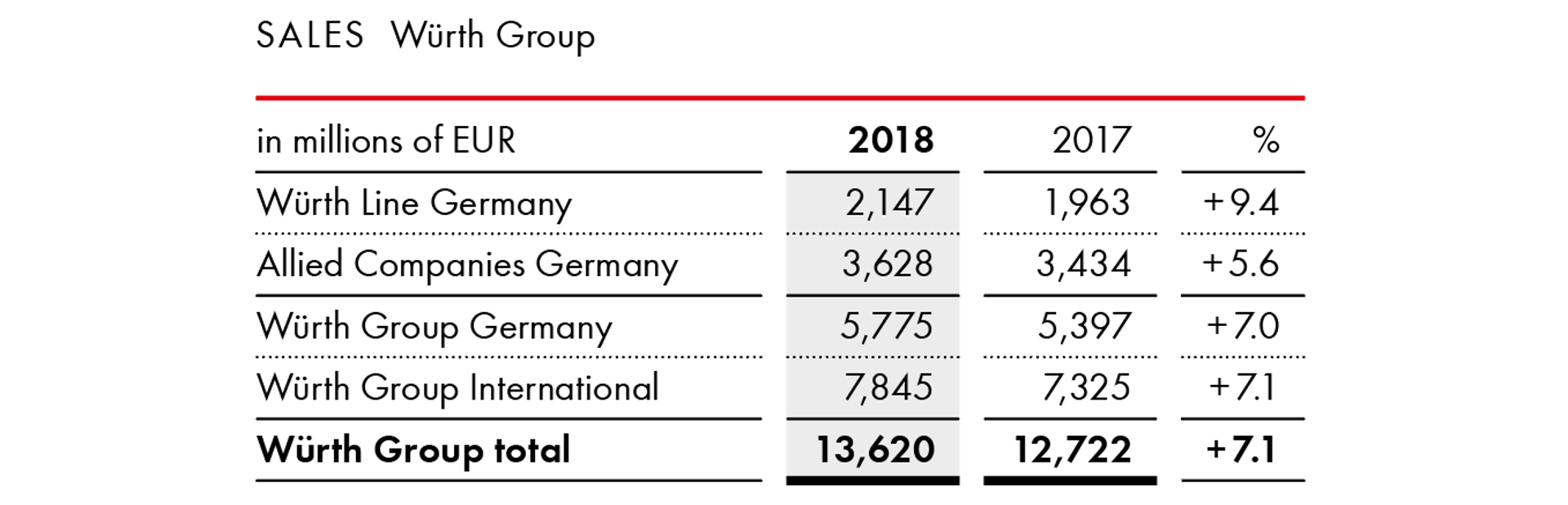

Germany is the most important individual market for the Würth Group, accounting for 42.4 percent of sales. In 2018, this market reported satisfactory sales growth of 7.0 percent, bringing sales to EUR 5.8 billion (2017: EUR 5.4 billion). Companies outside Germany grew slightly faster by 7.1 percent. Even if the growth dynamics are not at the same level everywhere, all regions of the Würth Group presented themselves as robust and were able to increase their sales.

One of the Würth Group’s strengths is decentralization. Thanks to geographical diversification, our more than 400 companies in over 80 countries allow us to participate in regional growth markets and thus, at least in part, compensate for stagnation or sales declines in individual countries. Depending on the maturity of the individual markets, the strategic approaches to market penetration vary from region to region. In fledgling markets, the focus is on expanding the sales force. The established entities concentrate on refining their sales divisions and expanding their sales channels, such as branch offices and e-business, through a regional approach, customer-specific segments and a policy of seeking out potential.

In Künzelsau, Germany, the cornerstone of the Würth Group was laid in 1945 with the founding of Adolf Würth GmbH & Co. KG as a screw wholesaler. This one-man operation has developed into the Group’s largest single company. A sales volume of EUR 1.7 billion was generated in 2018 by its 7,160 employees. This corresponds to an increase of 9.0 percent and is thus above the Group average. In addition to the sales force and the in-house sales, the more than 480 branch offices, in which our customers can cover their immediate needs, are a guarantee for the positive development of the company. The Group’s flagship is thus also closer to its customers than any of its competitors. Adolf Würth GmbH & Co. KG is pushing e-business in addition to enlarging its branch office network and the further expanding direct sales. Professionalism internally and externally is one of the reasons for the company’s high profitability. With an increase in profit to over EUR 160 million, it leads the internal ranking and thus sets standards within the Würth Group. This earning power is also a prerequisite for investments in forward-looking distribution, logistics and product solutions. Examples include the construction of a new transshipment warehouse directly on the A6 motorway and an innovation center that will be built on the Künzelsau campus.

In addition to Adolf Würth GmbH & Co. KG, the Group also has other extremely successful companies operating in Germany: Würth Elektronik eiSos, Würth Industrie Service, Reca Norm, Arnold Umformtechnik, and Fega & Schmitt Elektrogroßhandel are exemplary at the forefront in this regard. For years, these companies have shown a high degree of dynamism and professionalism. Out of a total of more than 33,000 sales representatives, 6,356 are employed in Germany. Overall, Germany generated an operating result of EUR 436 million (2017: EUR 421 million) and is thus the most profitable region.

Western Europe is the Group’s second-largest sales region with a sales volume of EUR 1,961 million, well behind Germany. Western Europe formed the geographical starting point for the internationalization of the Würth Group. Internationalization is one of the central success factors of the Würth Group. The Western European region grew by more than five percent for the second year in succession after only 1.4 percent growth in 2016. The restructuring of our Swiss direct selling company, which has been operating on the market for more than five decades, is still underway. France is the largest contributor to sales in this region, with a share of over 35 percent and growth slightly below the region’s average. Great Britain also belongs to the Western Europe region. The consequences of Brexit for our activities are not yet fully foreseeable. In 2018, the growth of the British companies was below average, both in euro and in local currency. By contrast, the companies in Austria closed 2018 with above-average results. Growth of 7.4 percent marks a record level within Western Europe.

With a share of 14.1 percent of the Würth Group’s total sales, the Americas represent the third largest region. These companies grew by 4.9 percent to EUR 1,917 million. At 11.3 percent, the rather restrained growth in euro terms is much more dynamic in local currency terms. In contrast to previous years, growth was achieved purely organically from within. Company acquisitions played no role in 2018. The largest single market in the region is the USA. The overall economic situation there has been somewhat dampened by the trade dispute with China, but the unemployment rate is at an all-time low in a 10-year comparison, which has boosted consumption—the traditional pillar of the US economy. This, together with the tax reform passed by the US Congress at the end of 2017, created favorable conditions for our US companies, which posted above-average growth of 12.0 percent in local currency terms.

South America also posted convincing results with above-average sales growth of 10.1 percent in local currency. This growth was significantly influenced by the largest company in the region, Würth Brazil. For the first time since 2011, Würth Brazil again achieved double-digit sales growth in local currency.

In Southern Europe, the very dynamic growth of the last three years continued: an increase of 12.9 percent to EUR 1,617 million for 2018. Particularly noteworthy are the developments in Spain with an increase in sales of 11.2 percent and Italy with 15.7 percent, both of which were positively influenced to a significant degree by Würth Line companies. It has always been part of the Group’s growth strategy to add targeted acquisitions to successful business areas where it makes sense to do so. Last year, the regional focus for acquisitions was on Italy. Würth Elektrogroßhandel (W.EG) expanded in Italy by acquiring a majority shareholding in M.E.B. Srl, one of the leading electrical wholesalers in Italy with headquarters in Schio, Veneto. M.E.B. Srl was founded in 1992 and achieved a sales volume of EUR 108 million in 2018. The company employs 282 people in 22 branch offices. The product range primarily includes lighting, building automation, low-voltage distribution and switching technology, renewable energies, cables, and industrial automation technology. The product range is supplemented by a wide range of consulting solutions and a broad service portfolio. A total of 11,454 colleagues are employed in the Southern European region, over 60 percent of whom work as sales representatives.

The Scandinavian region is home to one of the model companies in the Würth Group, Würth Finland. With more than four decades of operations behind it, the company is still impressive with its excellent market penetration and high profitability. The branch office concept is the decisive success factor here. Würth Finland now has more than 180 branch offices. The entity spearheaded the spread of this successful sales concept within the Würth Line in recent years. All in all, the Scandinavian region closed the 2018 fiscal year with moderate sales growth of 3.3 percent.

The momentum for growth within the Eastern European region was not quite able to match the very high level of 2017. However, with an 11.0 percent increase in sales, Eastern Europe is number two in the growth ranking. It is pleasing to note that the growth in sales was achieved by our own efforts. Growth in Poland, the country with the highest sales in Eastern Europe, was below average, as the integration of the acquisition in Würth’s electrical wholesale business has not yet been successfully completed.

The share of sales attributable to the remaining regions of Asia, Africa and Oceania has been stable at a level of just under five percent for years now. Although these regions are very large in terms of area, the companies in Asia, Africa and Oceania only play a minor role for the Würth Group at present.