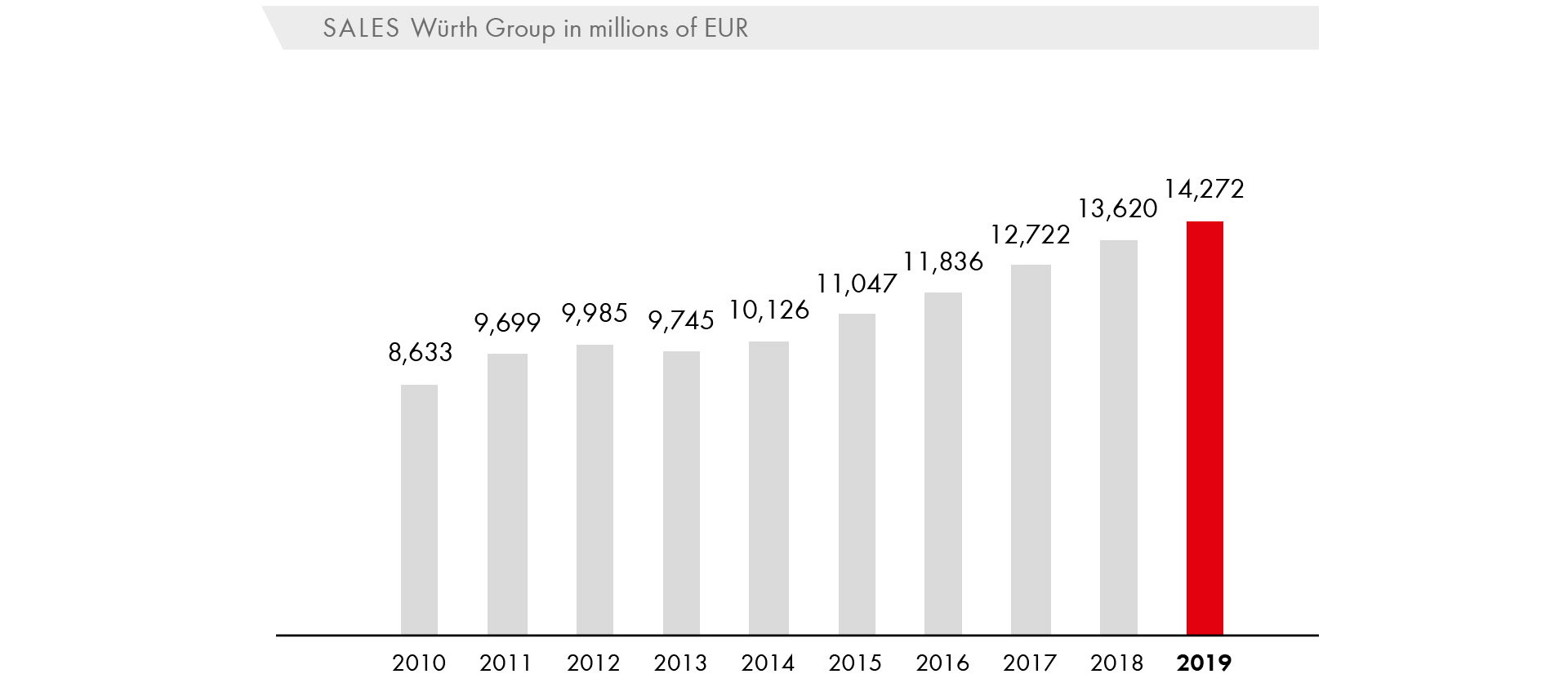

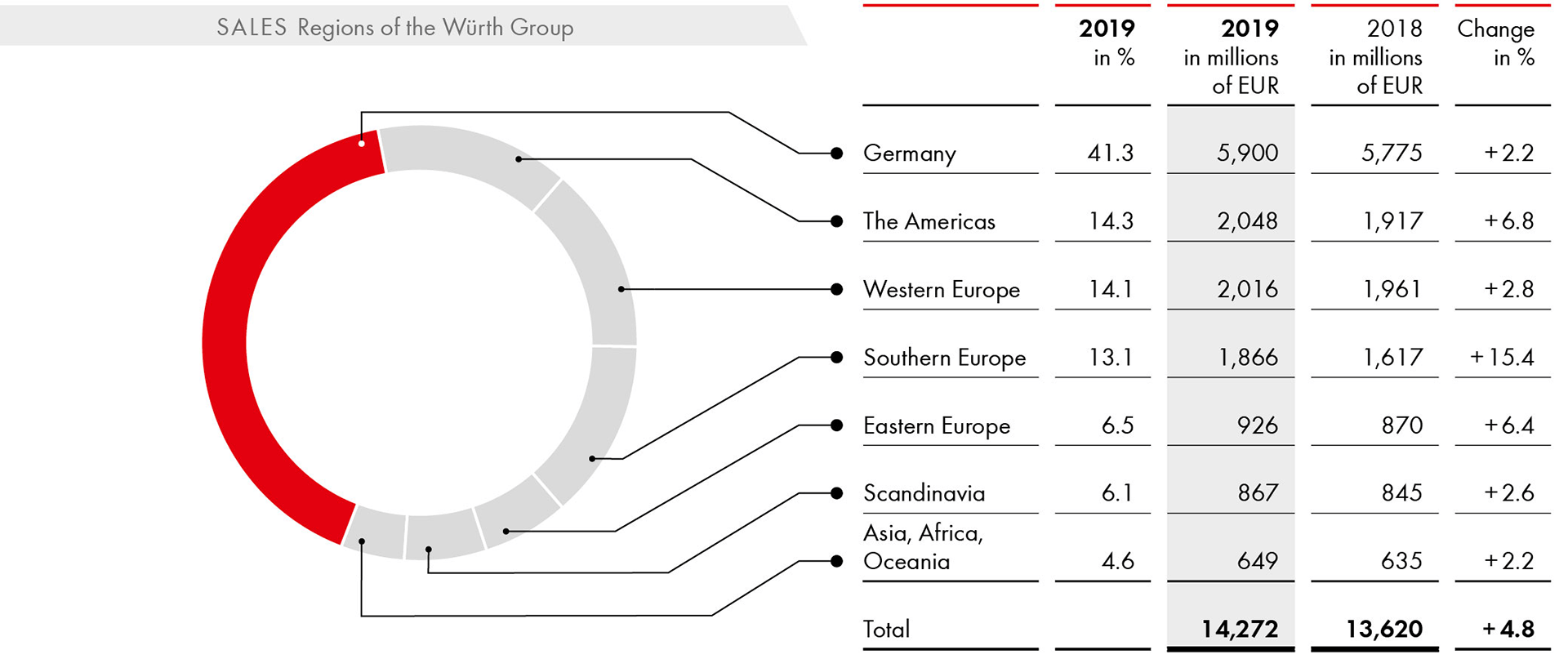

Sales by region

- Germany remains biggest individual market

- Strongest growth seen in Southern Europe

- Spain benefits from company acquisition

Southern Europe was the only region to report double-digit growth in 2019. With an increase of 15.4 percent, it was the fastest-growing region in the Würth Group, a trend that also benefited from acquisitions. Eastern Europe (6.4 percent) and South America (8.1 percent) also reported above-average growth rates, although the latter was held back considerably by exchange rate effects. Germany remains the most important individual market for the Würth Group, accounting for 41.3 percent of sales.

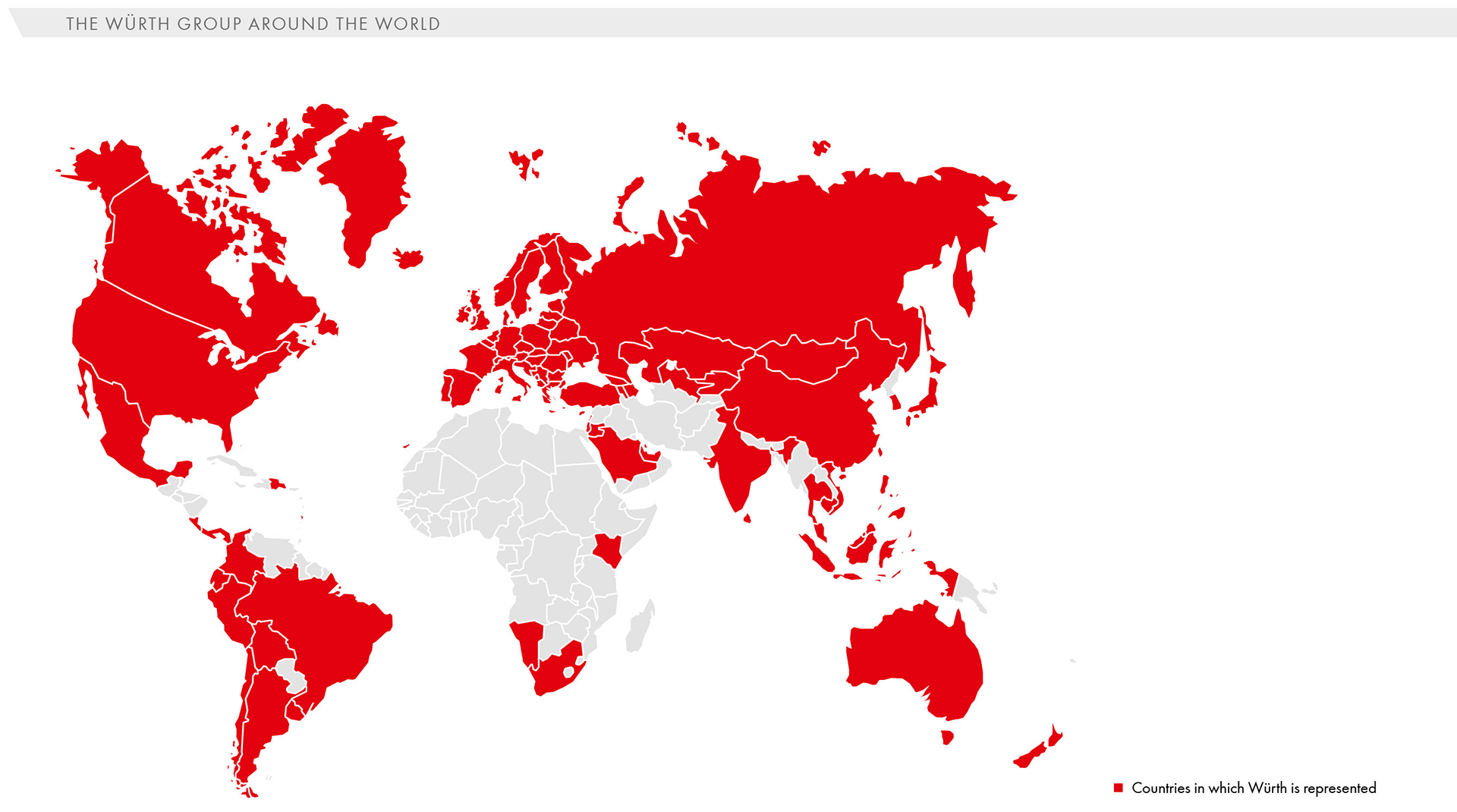

One of the Würth Group’s strengths is decentralization. Thanks to the geographical diversification, our more than 400 companies in over 80 countries allow us to participate in regional growth markets and thus, at least in part, to compensate for stagnation or sales declines in individual countries. Depending on the maturity of the individual markets, the strategic approaches to market penetration vary from region to region. In fledgling markets, the focus is on developing the sales force. The established entities concentrate on refining their sales divisions and expanding their sales channels, such as pick-up shops and e-business, through a regional approach, customer-specific segments, and a policy of seeking out potential.

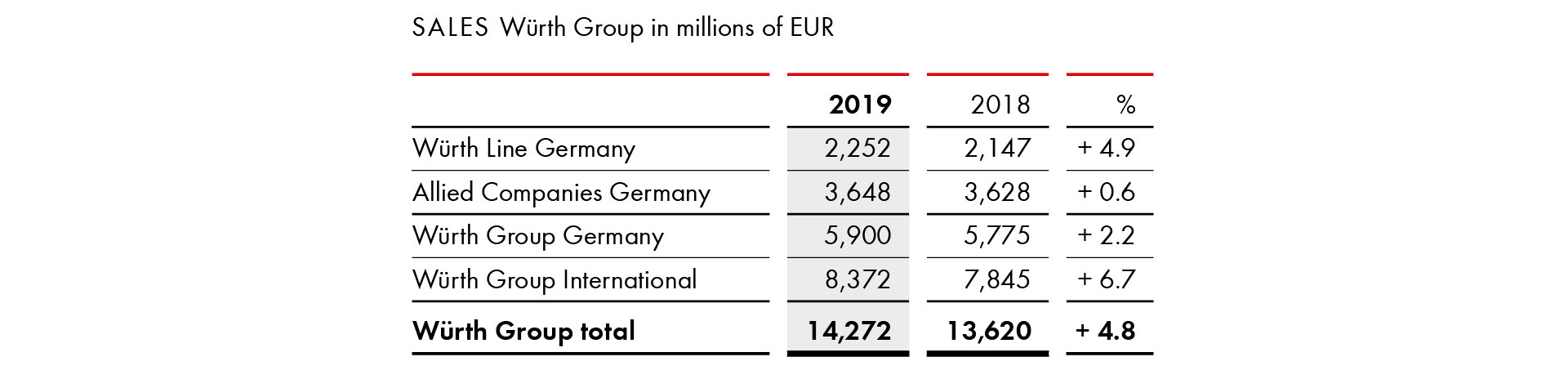

Sales growth in Germany came in at 2.2 percent in 2019, bringing sales to EUR 5,900 million (2018: EUR 5,775 million), a level that fell well short of expectations. The slowdown in the automotive industry in particular clearly left its mark on sales development. As the automotive industry is one of the main sectors that the Würth Elektronik Group, for example, supplies, this part of Würth was hit by dwindling sales. The drop in demand also translated into lower sales at the subsidiary Arnold Umformtechnik, which specializes in connection technology for the automotive manufacturing industry. At our major German tool distributors, Hahn+Kolb, Sartorius, and Hommel Hercules, the waning economic momentum also had a direct impact on business, leading to declining sales after five years of dynamic growth.

Developments at Adolf Würth GmbH & Co. KG tell a completely different story. Established back in 1945, it is the nucleus of the Würth Group and is celebrating its 75th anniversary in 2020. The company, together with its 7,418 employees, reached a new milestone in 2019: Its sales surpassed the EUR 2 billion mark for the first time in its history, totaling EUR 2,094 million, including intercompany sales.

This corresponds to an increase of 5.4 percent, outstripping the average figure for the Group. Alongside the sales force and in-house sales staff, the more than 520 pick-up shops, which our customers can use to cover their immediate needs, are key to the company’s positive development. Our Group’s flagship is also closer to our customers than any of our competitors. In addition to the expansion of the pick-up shop network and the further expansion of direct selling, Adolf Würth GmbH & Co. KG is forging ahead with activities in the e-business segment. Professionalism, both internally and externally, is one of the reasons behind the company’s high level of profitability. It tops the internal profit ranking table in absolute terms. This earnings power is also a prerequisite for our ability to invest in forward-looking distribution, logistics and product solutions. Examples include the construction of the new transshipment depot directly next to the A6 highway and an innovation center that is being built on the Künzelsau campus.

In addition to Adolf Würth GmbH & Co. KG, Fega & Schmitt Elektrogroßhandel GmbH can look back on an extremely successful fiscal year in which it also set a new record. Sales rose by 8.6 percent to EUR 515 million, breaking through the EUR 500 million barrier for the very first time. The company has been demonstrating a high level of dynamism and professionalism for years now, and has managed to double its sales in the space of only ten years.

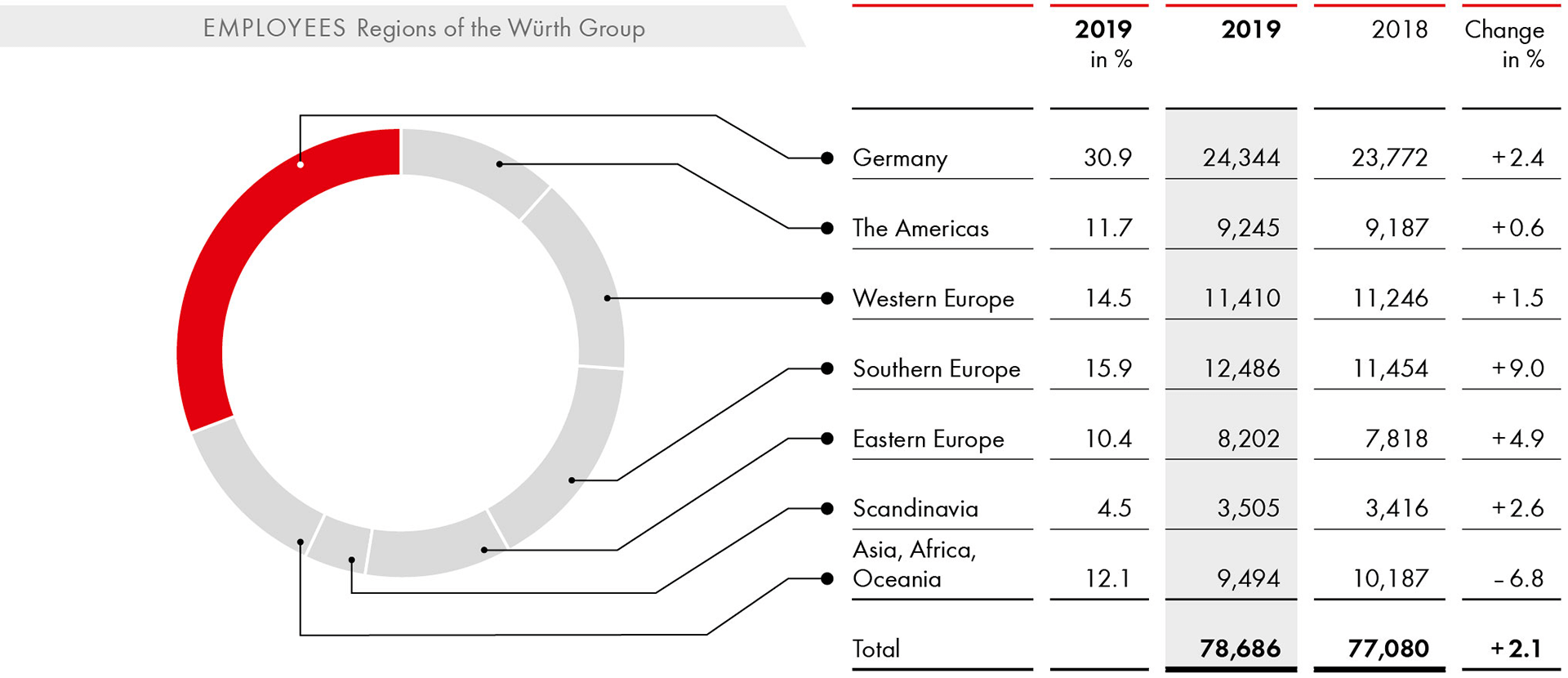

Out of a total of more than 33,900 sales representatives, 6,412 of them are employed in Germany. Overall, Germany generated an operating result of EUR 389 million (2018: EUR 436 million), thus representing the most profitable region.

For the first time, the Americas make up the second-largest sales region of the Würth Group, accounting for 14.3 percent of total sales. The companies stepped up sales by 6.8 percent to EUR 2,048 million. Sales growth was more subdued in local currency terms, largely due to developments in the US, the region’s largest individual market. The macroeconomic situation clouded over somewhat due to the trade dispute with China, although the country’s unemployment rate is at an all-time low, providing a boost to consumption—the pillar that has traditionally propped up the US economy. Companies in the Industry division and within Würth Elektronik in particular were unable to reap the benefits from these rather favorable economic conditions.

South America was one of the best-performing regions in the Würth Group with sales growth of 15.4 percent in local currency terms. The largest company in the region, Würth Brazil, delivered particularly convincing performance, reporting a double-digit increase in sales expressed in the local currency.

Western Europe was responsible for sales of EUR 2,016 million. This region is home to many of the Group’s more established companies, as it was where the internationalization of the Würth Group began. Western Europe is one of the key factors in the Group’s success. With growth of 2.8 percent, Western Europe fell just short of the growth rates achieved in previous years. This is due, among other factors, to the below-average development seen at companies in Austria, which was, in turn, influenced to a considerable degree by negative business development at fittings manufacturers. The companies in Switzerland, on the other hand, showed positive development, especially the Swiss direct selling company, which was able to shift up a gear again after a period of restructuring. France is the biggest source of sales in this region with a share in excess of 35 percent and a growth rate that outstripped both the regional average and the average for the Würth Group as a whole. The United Kingdom is also part of the Western European region. It is not yet possible to fully predict the consequences of Brexit on our activities. The British companies recorded lower sales, both in euro and in local currency terms, in 2019.

With growth of 15.4 percent in euro terms, Southern Europe clearly stands out from all of the Würth Group’s other regions as the only region to report double-digit growth. Although the increase was supported by acquisitions, it reflects the sustained upward trajectory that companies in this region have been on for no fewer than five years running. The companies in Italy and Spain in particular made a huge contribution to sales growth in the region, reporting sales growth of 12.4 percent and 28.0 percent respectively.

It has always been part of the Group’s growth strategy to add targeted acquisitions to successful business areas where it makes sense to do so. Last year, the regional focus of the Group’s company acquisitions was on Spain. Würth Electrical Wholesale Group (W.EG) expanded in Spain by acquiring 100 percent of the shares in Grupo Electro Stocks, S. L. U. The company was established in 1981 and is headquartered in Barcelona. Grupo Electro Stocks reported sales of EUR 284 million in 2019, employed a workforce of 975 in 66 pick-up shops, and operates in the electrical wholesale business, while also trading in heating, ventilation and air conditioning products, as well as in sanitaryware. The Southern European region employs a total workforce of 12,486, over 60 percent of whom work as sales representatives.

Although growth momentum in the Eastern European region was above average at 6.4 percent, this was not quite enough to match the high level seen in 2018. One positive development is the fact that the companies in Poland, the country with the highest sales in the region, more than doubled their growth momentum year-on-year by 9.2 percent. It is also encouraging to see that we achieved the sales growth witnessed in this region under our own steam. The Würth Group employs more than 8,000 people in the region.

The structure of companies in the Scandinavian region has been relatively stable in recent years, which also reflects the maturity of the market. Nevertheless, the region is home to one of the model companies in the Würth Group, Würth Finland. With more than four decades of operations behind it, the company consistently impresses with its excellent market penetration and high profitability. Würth Finland also spearheaded the spread of the successful sales concept of “pick-up shops” within the Würth Line. The company now has 185 pick-up shops.

Asia, Africa and Oceania still only play a minor role for the Würth Group at present. The share of sales attributable to this region has been stable at a level of just under five percent for years now.