Net assets, financial position and results of operations

- Operating result down to EUR 770 million

- Investments reach record high

- Equity ratio of 44.0 percent

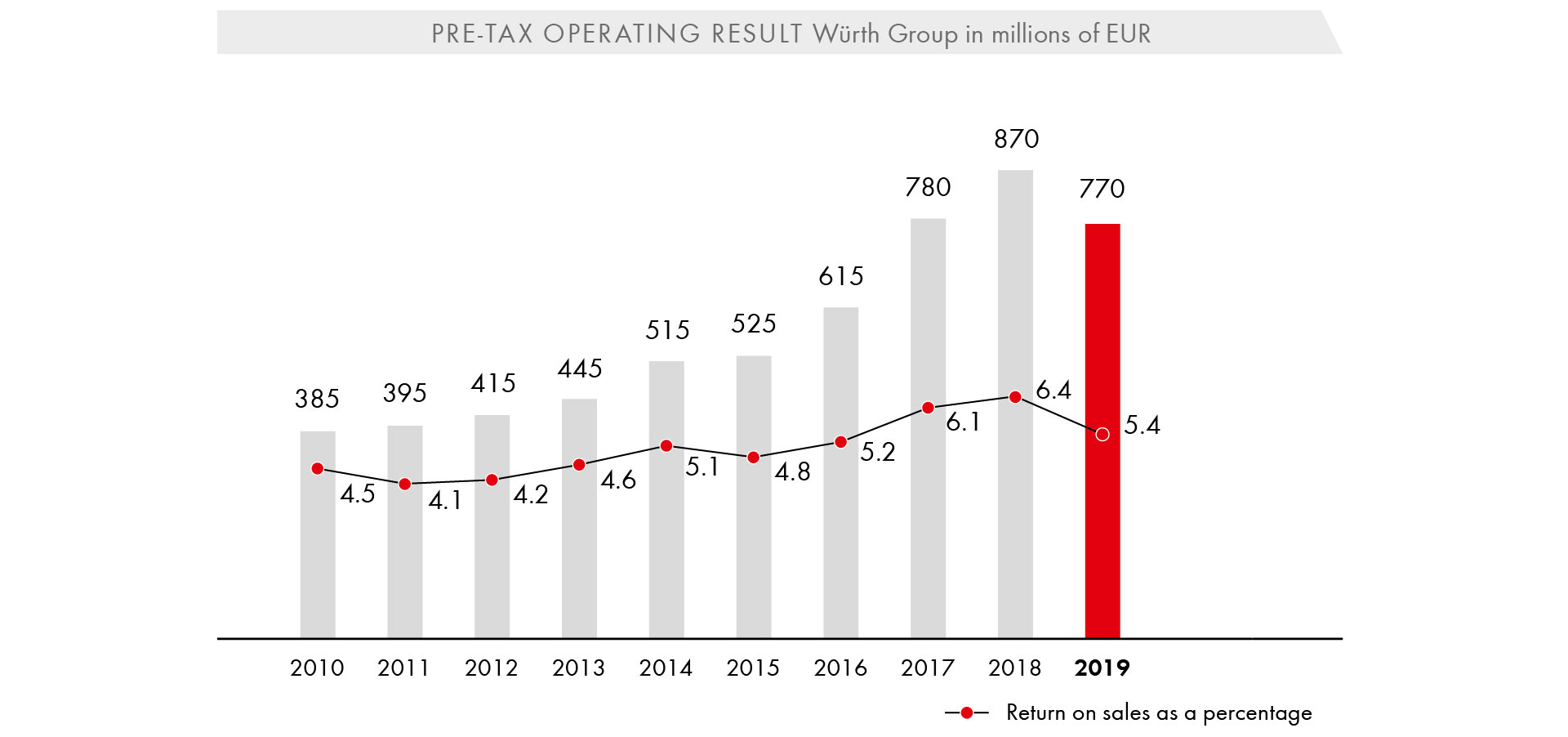

At EUR 770 million, the Würth Group was unable to match the record operating result of EUR 870 million achieved in the previous year. The operating result fell by 11.5 percent, bringing the return down to 5.4 percent (2018: 6.4 percent). We have calculated the operating result as earnings before taxes, before amortization of goodwill and financial assets, before the collection of negative differences recognized in profit or loss, before the adjustment of purchase price liabilities from acquisitions through profit or loss, and before changes recognized in profit or loss from non-controlling interests disclosed as liabilities.

In Germany, the operating result fell by 10.8 percent to EUR 389 million (2018: EUR 436 million), a drop that was only slightly less pronounced than that seen at companies outside of Germany (–12.2 percent). The drop in earnings in Germany is due, first, to the fact that the German market is more heavily reliant on the automotive industry/mechanical engineering sector from the perspective of the Group as a whole. The negative trend in those industries put pressure on earnings at companies trading in tools, within the Würth Elektronik Group and at individual manufacturing companies.

The share of the Group’s overall result attributable to the German companies was 50.5 percent, with the return on sales amounting to 6.6 percent (2018: 7.5 percent). With an operating result in excess of EUR 160 million, Adolf Würth GmbH & Co. KG made what was by far the biggest contribution to earnings of any other single company in the Group. Other top performers within Germany include: Würth Elektronik eiSos, Würth Industrie Service and Fega & Schmitt Elektrogroßhandel.

As far as the companies outside of Germany are concerned, reliance on particular areas of the economy was once again reflected in earnings development. This was compounded by a need for restructuring at individual industrial companies in the US and by the gross profit margin, which came under pressure. It was not always possible to pass on rising purchase prices to the customers on the market. The situation in the United Kingdom also remains challenging due to the uncertainty surrounding Brexit. As things stand at the moment, however, we do not expect Brexit to have any significant impact on the Würth Group’s net assets, financial position and results of operations. The companies outside of Germany achieved an operating result totaling EUR 381 million (2018: EUR 434 million).

The ratio of cost of materials to sales was up slightly on the previous year at 50.1 percent (2018: 49.9 percent). It was impossible to keep this ratio stable due to rising commodity prices. At EUR 108 million, other operating income was higher than in the previous year (2018: EUR 96 million). The 12.0 percent increase is due primarily to the remeasurement of earn-out liabilities at US industrial companies.

At the end of December 2019, the Würth Group had a total of 78,686 employees. Face-to-face contact is the strength of our direct selling approach. The sales forces work hand in hand with our highly effective in-house staff, who provide the necessary support for the specific sales strategy. A total of 761 additional employees joined the sales team in 2019. The workforce in our in-house departments increased by 1.9 percent. A total of 996 employees joined the Group as a result of acquisitions. The ratio of personnel expenses to sales was up slightly on the previous year at 27.0 percent (2018: 26.8 percent).

Amortization and depreciation virtually doubled in a year-on-year comparison to EUR 721 million (2018: EUR 375 million), mainly due to the first-time adoption of IFRS 16. The application of this standard increases property, plant and equipment (right-of-use assets), with a knock-on effect on depreciation. Without the application of IFRS 16 and without the rise in impairment losses on goodwill relating to the US industrial companies in the amount of EUR 54.3 million, amortization and depreciation would have increased by 7.9 percent. This increase is due to the increased investment and the acquisitions made by the Würth Group in recent years.

Other operating expenses fell by 7.2 percent as against the previous year. The ratio was down considerably year-on-year to 13.1 percent (2018: 14.7 percent). This drop is, however, due first and foremost to the first-time adoption of IFRS 16. In the past, for example, rental and lease costs were reported under other operating expenses. The new standard means that these expenses are now assigned to amortization and depreciation, or interest expenses. Adjusting to reflect this effect, other operating expenses would have risen by 6.0 percent.

The tax rate fell in the 2019 fiscal year to 18.8 percent (2018: 20.5 percent). One of the main reasons behind this development was a change in the tax base for the coming fiscal years in Switzerland, reducing taxes in 2019 due to the recognition of a deferred tax asset. The reversal of previous impairment losses on temporary differences also had a positive effect. The increase in non-tax-deductible amortization of goodwill, primarily with regard to US industrial companies, had the opposite effect. For a detailed analysis, please refer to Section G. Notes on the consolidated income statement, [10] “Income taxes”, in the consolidated financial statements.

The Würth Group achieved a new sales record of EUR 14.3 billion in the 2019 fiscal year. Despite the increase in sales, the operating result lagged behind the previous year at EUR 770 million. Net income for the year fell to EUR 595 million. Our gross profit, meaning sales minus the cost of goods sold, along with our staff turnover, stock turnover and sales per employee, improved or are at an acceptable level. This means that the sales target was met, whereas the operating result fell short of the expectations of the Central Managing Board. If we take the developments in the global economy into account, which started to cloud over considerably as of the third quarter of 2019, these results can be classed as satisfactory.

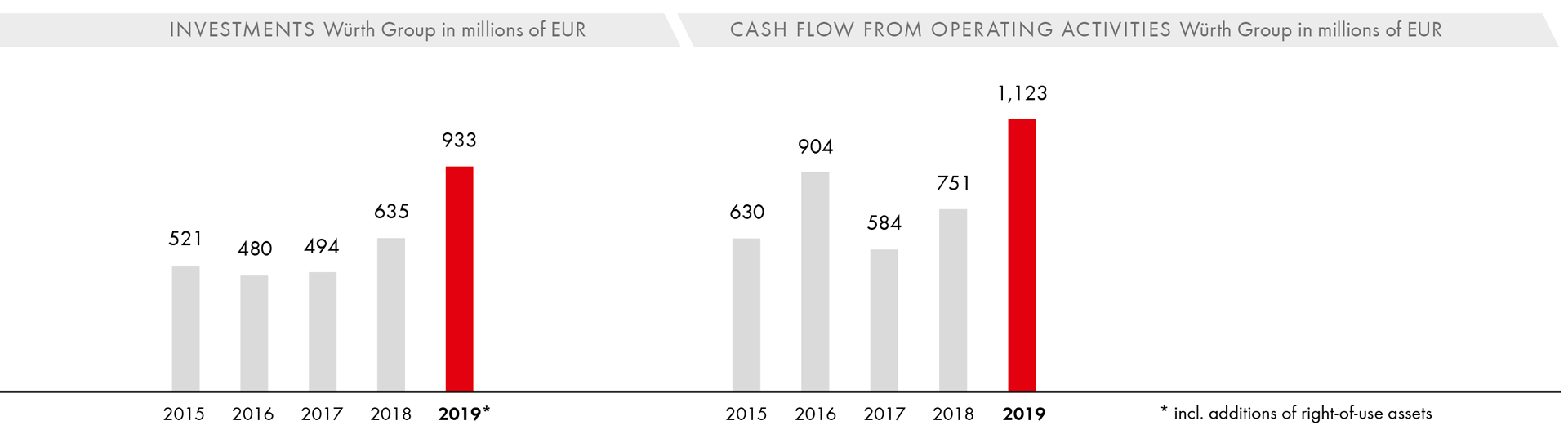

Capital expenditures and cash flow

Growth is inextricably linked to the self-image of the Würth Group. Growth by tapping into new markets and growth in existing markets require optimal overall conditions. One of the ways in which the Würth Group achieves such conditions is through sustainable investment. Over the past ten years, the Group has invested around EUR 4.8 billion in intangible assets and in property, plant and equipment. In the last fiscal year, investments in the total amount of EUR 705 million (2018: EUR 635 million) focused on the expansion of IT infrastructure and warehouse capacities for our distribution companies, as well as on production buildings and technical equipment and machinery for our manufacturing companies.

SWG Schraubenwerk Gaisbach GmbH expanded its production capacities in Waldenburg with the construction of a state-of-the-art hall spanning a surface area of 96 x 113 meters. Just under 1,700 cubic meters of wood were used in the construction process—around a quarter of which was BauBuche, a laminated veneer lumber. Allowing for a span of up to 82 meters using only one mid-section support, the innovative BauBuche material offers the very highest levels of stability. The total amount invested comes to around EUR 30 million. By deliberately opting for timber construction, SWG is sending out a clear signal, pointing to the positive impact of the natural material in terms of climate protection thanks to its ability to store CO2.

Grass GmbH, Austria, made the biggest investment in its history, constructing a central warehouse in Hohenems. The manufacturer of movement systems for high-quality furniture constructed a logistics center featuring a state-of-the-art office and customer center in order to optimize its supply chain management. Around 100 employees will start work in Hohenems in mid-2020. The central warehouse offers a total of 37,800 pallet bays on 22 levels. The total amount invested comes to around EUR 70 million.

In addition to the Allied Companies, the Würth Line companies also made substantial investments in stepping up their sales activities. Over the last 18 months, Würth Austria has invested EUR 20 million in extensive measures to expand and modernize its logistics center at the company’s headquarters in Böheimkirchen. The expansion measures created 60,000 additional storage spaces thanks to a fully automated shuttle warehouse. More than 55,000 customers across Austria place their trust in Würth. An average of around 6,000 to 7,000 packages weighing a total of 80 metric tons are sent out every day. The moves to expand and modernize the company’s logistics facilities also involved the decision to transition the Böheimkirchen site to environmentally friendly power generation. The new and innovative conveyor technology allows for a significant reduction in the volume of filling material required, as the technology has the ability to adjust to individual package heights. Renewable raw materials make up 100 percent of the organic air cushions used, which are made of potato and maize starch. At the same time as the logistics expansion measures back in the summer of 2019, the company also commissioned what is currently the biggest photovoltaic system designed for a company’s own use in Lower Austria, featuring an output of 730 kWp (kilowatts peak).

After a planning and construction phase spanning more than a year, Würth Czech Republic moved into a new warehouse and office building in January 2020. The warehouse offers space for 3,000 pallet and 15,000 lower shelf spaces, and will form the basis for the company’s planned growth, as well as for an increase in logistics productivity. The amount invested came to just under EUR 11 million.

In addition to investments in production and storage space, we have also, as in previous years, invested in our ORSY® storage management system, which offers our customers storage and provision options for various consumables and supplies in line with their needs.

In total, EUR 371 million, or 52.6 percent of the investment volume, was attributable to Germany, reflecting the continued paramount significance of the home market for the Würth Group.

Thanks to our efficient investment controlling processes using sophisticated recording and analysis tools, the Central Managing Board is always in a position to react quickly to changes in the overall environment. This is another reason why we once again met our objective of financing investments in intangible assets and in property, plant and equipment from our cash flow from operating activities in full in 2019. Our cash flow from operating activities came in at EUR 1,123 million (2018: EUR 751 million), up by 49.5 percent on the previous year. The first-time adoption of IFRS 16 also had a considerable impact on this increase. Further positive effects resulted from lower inventory accumulation and a less pronounced increase in trade receivables compared with 2018. These effects more than offset a contrary effect resulting from the lower increase in liabilities from financial services.

Purchasing

The year 2019 was characterized to a considerable degree by increasingly gloomy economic forecasts. This is confirmed if we take a look at the purchasing managers’ indices for the world’s three leading economies (eurozone, US, China), which serve as leading indicators of developments in these economic areas.

The purchasing managers’ index for the eurozone had already slid to below the key 50-point expansion threshold at the beginning of 2019 and closed the year at 46.3 points in December 2019. This suggests that leading buyers in this economic area expect to see negative market developments.

The purchasing managers’ index for the US economy tells a similar story. It fell to 47.2 points at the end of 2019 and is also well below the 50-point expansion threshold. The purchasing managers’ index for China, on the other hand, did not show any negative trend in 2019, although it remained very volatile over the course of the year. It climbed to 51.5 points in December 2019, making it the only indicator to exceed the 50-point expansion threshold.

The procurement markets certainly felt the impact of the trade conflict between the US and China in 2019, as well as the effects of the marked global economic slowdown in comparison to the prior year. The shortage of raw materials that had persisted in some areas, such as refrigerants, in 2018, was no longer an issue in 2019. The tense capacity utilization situation experienced by many manufacturers, as well as the long delivery times that this entailed, also returned to normal as the year progressed. Particularly in the fourth quarter of 2019, for example, significant capacity shortages came to light when attempting to purchase connecting elements from suppliers. Nevertheless, 2019 brought periods of very long delivery times in some product areas, for example engine oils.

The euro to US dollar exchange rate remained on a negative trajectory throughout the year, falling from 1.145 in January 2019 to 1.123 at the end of December. This trend had a negative impact on purchases of products from third countries.

Looking ahead to 2020, we expect the world’s major economies to continue to feel the impact of the 2019 economic downturn. We will see a clear shift from the seller’s market that we have encountered to date towards a buyer’s market. It will be crucial for buyers to exploit the price optimization opportunities resulting from this shift.

In the course of 2019, a value management function was established to enhance the Würth Line’s procurement processes even further. This function aims to use value analysis approaches to strengthen product price transparency within the Purchasing function of the Würth Line so as to provide additional support to buyers in their negotiations with suppliers.

Inventories and receivables

As a company with international operations, the Würth Group’s inventories and receivables are key balance sheet items which the company’s management is continually seeking to manage and optimize. Both balance sheet items allow for short-term controlling and optimization of liquidity and tied-up capital in the Group. This involves striking the right balance between making sure that our customers are satisfied on the one hand—by offering the best delivery service and adequate payment periods—and optimizing the business-related key figures on the other hand.

The 4.8 percent sales growth achieved in the 2019 fiscal year came hand-in-hand with an increase in inventories and receivables. The 3.7 percent increase in inventories to EUR 2,288 million lagged behind the increase in sales (2018: EUR 2,205 million). Acquisitions resulted in extra inventories worth EUR 40.9 million.

After an increase in inventories in the first three quarters of 2019, inventory control measures were stepped up in the individual business units to counteract inventory accumulation. The Central Purchasing and Product Management departments also worked closely to press ahead with projects aimed at streamlining the core range. The idea behind these projects was to eliminate products with low demand in order to reduce the core range to a total of 10,000 items. Stock turnover, calculated on a 12-month basis, fell slightly from 4.8 times at the end of 2018 to 4.7 times at the end of 2019.

Due to inventory levels that were high overall, our supply capability remained consistently high throughout the year. The service level in 2019 came to 97.3 percent, meaning that 97 out of 100 items ordered were delivered to the customer the next day. By offering this sort of service, we aim not only to satisfy our customers but also to inspire them.

Trade receivables rose by 4.8 percent to EUR 1,975 million (2018: EUR 1,885 million). Acquisitions resulted in extra receivables worth EUR 102 million. For years, sophisticated controlling systems, which enable rapid responses in the event of any indications of negative developments, and an optimum interplay between sales and accounts receivable management have enabled the Würth Group to achieve a low level of receivables in relation to sales. The corresponding key figure, collection days (based on a 12-month calculation), at 54.8 days could not, however, quite keep up with the level achieved in 2018 (53.6 days). Nevertheless, we are satisfied with this result, considering that the increase is largely due to the acquisitions of electrical wholesale companies in Italy, where payment terms traditionally tend to be longer.

One encouraging development is the fact that collection days in Germany have been at a low level of 42 days for years now.

We will continue to optimize accounts receivable by means of effective cooperation between sales and accounts receivable management, as well as by refining our analyses. We see the payment patterns of debtors as critical in Eastern Europe, Southern Europe, China, the Middle East, and India. This also has the effect of slowing growth.

The percentage of bad debts and the expenses from additions to value adjustments related to sales increased to 0.4 percent (2018: 0.3 percent).

Financing

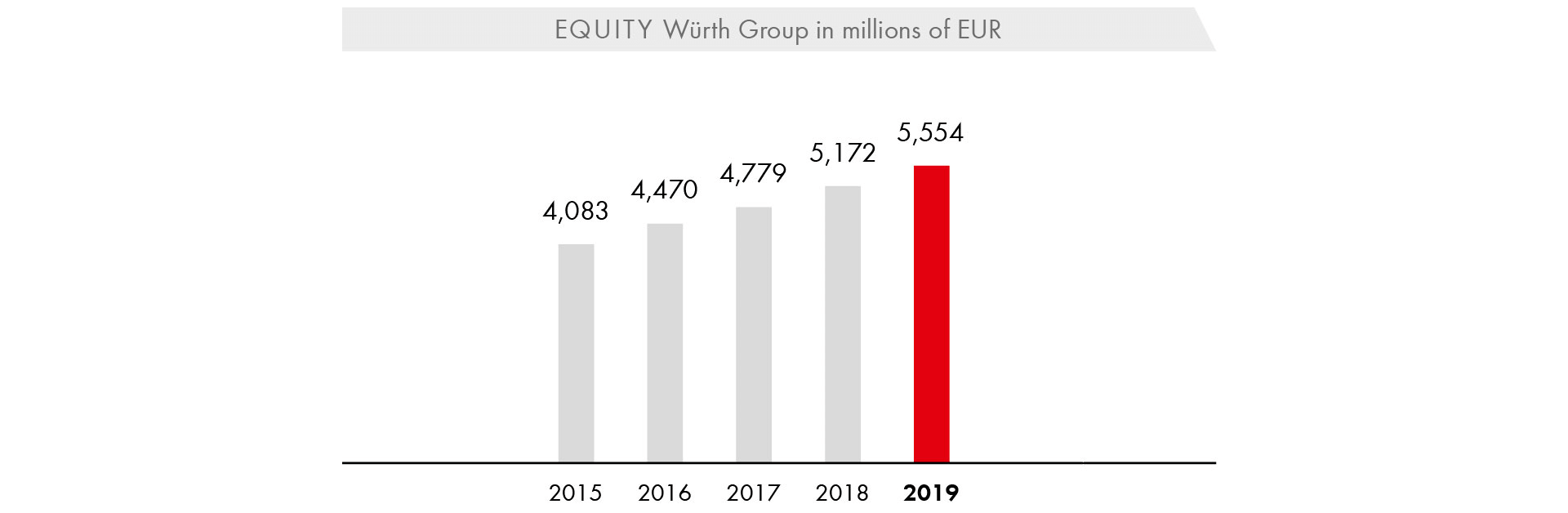

The equity of the Würth Group climbed by 7.4 percent to EUR 5,554 million in the past year, an increase of EUR 382 million. This increase allowed the company to maintain its equity ratio at a level of 44.0 percent, which is high for a trading company (2018: 47.1 percent). The drop in the equity ratio is due primarily to the first-time adoption of IFRS 16. For years, a good level of equity capitalization has been the basis for consistently high levels of financial stability and the solid financing of our group of companies, strengthening customers’ and suppliers’ trust in the Würth Group. This is due to the typical family business approach of reinvesting a large portion of profits in the company. The high level of equity financing allows the company to be relatively independent of external capital providers. Total assets rose by EUR 1,653 million to EUR 12,627 million in the reporting period (2018: EUR 10,974 million). Half of the 15.1 percent increase is due to the first-time adoption of IFRS 16. An amount of EUR 885 million was reported for the first time as right-of-use assets. In turn, lease liabilities totaling EUR 910 million were recognized for the first time on the liabilities side. The increase in total assets was also driven by the rise in property, plant and equipment. Net debt, excluding the effects associated with IFRS 16, increased from EUR 1,207 million in 2018 to EUR 1,356 million as a result.

Financial service activities also contributed to the growth in total assets. Refinancing in the banking sector was mainly achieved through financial intermediaries and refinancing programs launched by the European Central Bank, while refinancing in the leasing segment was achieved mainly through the ABCP (Asset Backed Commercial Paper) program created especially for this purpose, a global loan program launched by the German state-owned development bank KfW, as well as through non-recourse financing and internal funds.

The Würth Group has undergone an annual rating process for more than 20 years now. The leading rating agency Standard & Poor’s once again confirmed the Würth Group’s “A /outlook stable” rating in 2019. This rating reflects the confidence that business and the financial KPIs will continue to develop successfully. The opportunities and outlook for the Würth Group are viewed in a positive light. Our long history of good ratings not only documents the positive credit rating; at the same time, it is proof of the continuous and successful development of our corporate group and the stability of our business model.

At the end of the 2019 fiscal year, the Würth Group had three bonds issued on the capital market and one US private placement. All covenants in this context have been complied with. In 2020, 2022 and 2025, bonds worth EUR 500 million each will reach maturity, while the private placement of USD 200 million is set to reach maturity in 2021. This means that the maturities are well spread out. For further details on the maturity profile and interest structure, please refer to [26] “Financial liabilities” in Section H. Notes on the consolidated statement of financial position, in the consolidated financial statements.

As of 31 December 2019, the Würth Group had liquid funds of EUR 477 million (2018: EUR 493 million). In addition, the Group has a fixed credit line of EUR 400 million, which remains undrawn to date, provided by a syndicate of banks until July 2023. This means that the company has sufficient liquidity reserves. In order to refinance the bond that will mature in 2020, funds are likely to be raised on the capital market in the course of the current fiscal year as part of the existing “Euro Medium Term Notes” program. This program offers a high degree of flexibility for issuing bonds and serves as a means of long-term financing for the Würth Group.